And pay ZERO capital gains It’s possible to make $500,000 a million dollars or even $10 million with crypto And pay ZERO capital gains tax.

Is It Really Possible?

Do you believe me? Probably not. Should you believe me? Yes, because this is actually very doable, and it’s really not that difficult. In fact, you can use the same exact method for stocks or for businesses, anything that you want to save capital gains tax on.

Step-by-Step Savings Guide

To save capital gains tax on So let’s break this down step by step on how you can set up your assets in a very particular way to both save you money and benefit society while you’re at it. Even if you don’t have a lot of money for when you do have a lot of money and your future self will thank you for this ten minute investment.

Dealing with Increased Value Investments

So let’s go ahead and get into it. This plan works especially well if you’ve bought something that has dramatically increased in value, and if you decide to sell or diversify out of that thing, it means a huge tax bill. So let’s say you invested $5,000 into Bitcoin years ago now it’s worth $505,000, a gain of 500 grand.

Addressing Capital Gains Taxes

First off, Congratulations. That’s quite the feat. But if you want to sell or diversify, you have a whole lot of taxes to pay. The good news is you’ve been holding longer than one year, so that means no short term capital gains. But bad news is you still have long term capital gains, and that can add up.

Calculating Potential Tax Impact

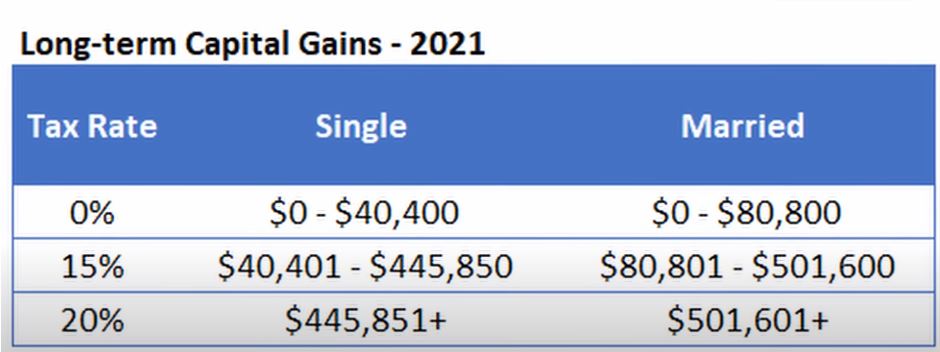

If you were to sell that $505,000 in Bitcoin, you would pay a long term federal capital gains of around 20%. And of course, States need to get their cut of the action, and that can be anywhere between 0% and 13.3%, depending on your state. The average is 5% capital gains tax for States. So for this example, we’re going to do 25% total capital gains tax.

A Closer Look at 25% Total Capital Gains Tax

25% total capital gains tax At 25%, your $500,000 in profit would have $125,000 in taxes taken right off the top. And there is nothing you can do about it or can you? Yes, of course. One option is to move to Puerto Rico and become a member of act 60, wait ten years, and then you only pay 5% capital gains tax. But that might not be an option for you. And frankly, we have a better option. Also, it’s very important to note that you only have options before you sell. If you’ve already sold, your options are basically gone. Double also, I am not a financial advisor. Consult all of this with a tax professional before doing anything crazy.

Saving with Charitable Remainder Trusts

Okay, so how do we save that $125,000 in tax? We’re going to do this through a charitable Charitable Remainder Trust remainder trust, aka, a legal way to save a boatload of tax, do good for society, and still leave money for your kids or your cat or whoever you want to leave money to. If that sounds good, you’ll. You’ll also want to grab one of the remaining 20 spots for my Patreon, where I have even more private money making content. Grab one of those before it sells out yet again.

Understanding Charitable Remainder Trusts

So, the most simple way to describe a charitable remainder trust is it’s basically a fund that you set up that says, after I die, I want this money to go to a charity of my choosing. And you might be thinking, well, you know, charity is great and all, but I wanna actually use the money that I made in my investment. And to that I say, Hold your horses, we’re not done yet. We haven’t gotten to the best part yet.

Setting Up Your Charitable Remainder Trust

- So let’s backtrack a bit.

- We have $125,000 in an expected tax bill if we sell.

- So first we reach out to a lawyer and we have them form a CRT for us.

- Then you need to choose a charity that you’re going to donate your money to.

- That charity needs to be a 501(c)(3) legitimate charity.

- And then you set yourself as a lifetime beneficiary of the Charitable Remainder Trust.

- Now that it’s set up, you’re going to donate your $505,000 in crypto or stocks or other assets to your CRT.

- So your CRT is actually going to have its own crypto wallet that you send that crypto to.

- It’s a completely separate entity from yourself.

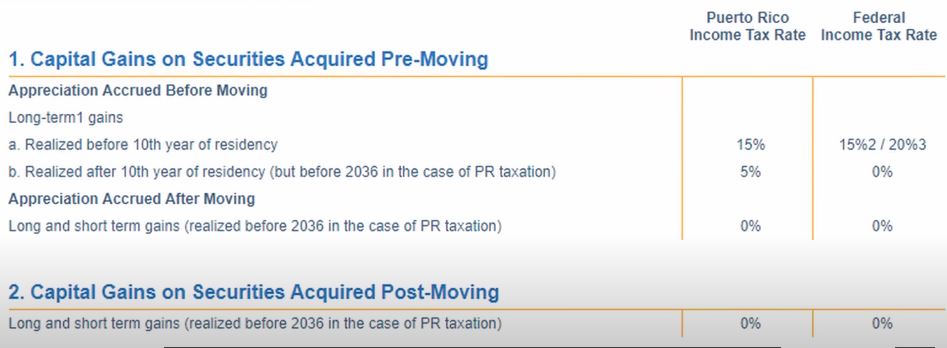

- Now, what’s interesting here is your CRT is actually a charitable entity in and of itself.

- So by transferring the funds, you get a tax deduction right away because you’re putting it into a charitable entity for donating money to your own charitable trust.

- It’s like it’s your very own kind of like make a wish, except your wish is to pay less tax, and then you got your wish.

Immediate Tax Deduction Benefits

So you get an instant tax deduction. However, it’s important to note that you don’t get a 100% deduction on your donation because you aren’t actually donating it to a 501(c)(3) until you die, which is hopefully a long time from now. So there’s this present value calculation that is done on your money. This is because money 40 years from now is worth less than money today. So instead of deducting 100%, you could deduct around 30% to 40% from your taxes. And of course, this can vary a little bit. If you were, for example, to donate to a private institution like a College or your very own charity, that percent deduction would be a little bit lower than 30 or 40%.

Estimating Tax Deductions

| Assumption | Deduction |

|---|---|

| You’re donating to a public eligible institution. | |

| We’re gonna estimate on the low end with a 30% deduction against your taxes. | |

| Calculation | Amount |

| This means on our $500,000 we just got a tax deduction of $150,000. | $150,000 |

| Year-wise Deduction | Amount |

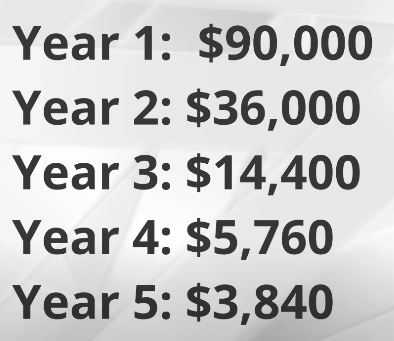

| Year one, you get to deduct 60% of this balance against your income, every year for five years. | |

| Year one | $90,000 |

| Year two | $36,000 |

| Year three | $14,400 |

| Year four | $5,760 |

| Year five | $3,840 |

Benefits of Five-Year Tax Deduction

Okay, so we get this nice little benefit on our income tax for the next five years. But it doesn’t stop here. So far we’ve just transferred our Bitcoin to the Charitable Remainder Trust. There is a whole lot more goodness coming. So we haven’t sold it yet. The next step is to sell it. Now, when you sell, you’re selling capital gains tax free, because it’s not actually you selling it. It’s a charity selling it. And say it with me, Charities don’t pay taxes. Charities don’t pay tax But we’re not done yet. Here’s how you really benefit. Now that you’ve sold, you have options.

Maximizing Your Trust’s Potential

You can leave the trust as cash, which you probably don’t want to do. Or you could buy other assets within the trust. You could buy real estate, you could buy a business, you could buy even more crypto. You can really buy any kind of asset. And then you set up an annuity. This can either be percent based or a flat amount every single year. This will be paid out to you from the charitable trust until you die. And if you go with the percent, it has to be at least 5%. For this example, we’re just going to go with 7% paid annually.

Annual Annuity Payments

So now you get 7% paid of your $500,000 every single year, $35,000 every year until you die. Give or take a little bit depending on the portfolio’s performance and a charity will benefit in the end. Now, it’s important to point out that you do pay tax on the annuity payments every year at your regular income tax rate. But remember, you do have that nice little tax deduction for the first five years, thanks to your initial donation of $500,000.

Legal Protection of Trust Assets

Now, a side benefit here is the money within this trust is totally protected from personal liability. I mean, you could go and crash your car into a preschool and be fine. I’m not saying you should. That’s definitely not financial advice. You shouldn’t do that. But if you did, your charitable trust cannot be touched. Now you might be thinking, you know this sounds great and all, the trust part, not the running into a pre-school, and crashing into pre-school part. But I wanna give my- [Laughs] sorry. But I wanna give my money to my kids when I die. Not necessarily everything to a charity. So this won’t work for me, and you would be wrong. You can still do this as well.

Using Irrevocable Life Insurance Trusts

So in order to do this, you need to call up your lawyer and have them set up an irrevocable life insurance trust. This is a life insurance policy that you’ll set on yourself for $500,000 And how do you pay for it? With your ann