Over the past 6 months there’s been an unprecedented amount of anticipation for one of the biggest events to happen in crypto. Between news articles and billboards, everyone was talking about the Bitcoin halving. But the problem is, even though we as experienced investors anticipated that we would get a selloff, a lot of new investors piled in in anticipation. Since then, Bitcoin has dropped nearly 15% at its lows and the overall sentiment is getting destroyed.

Seizing Opportunities in Bad Market Sentiment

But if I’ve learned anything from making a tremendous amount of money in crypto over the past several years, it’s that when sentiment is bad, this is exactly where the best opportunities lie to make those life-changing investments. So in this video, I’m going to explain why Bitcoin is dumping and why it really doesn’t matter that much at all. I’m going to explain in detail why I think the real opportunity is yet to come. Then I’m going to go over my preparation game plan and talk about some of the projects that I believe could be sleeping giants for this next cycle that can allow us to make those tremendous gains.

Engage with Our Trading and Investing Community

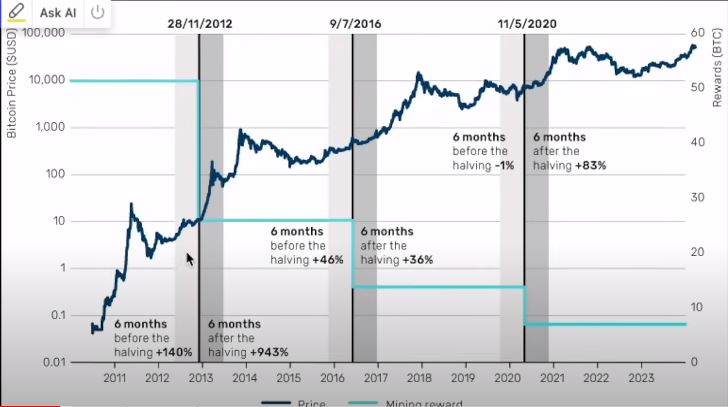

If that sounds good, make sure you hit the like button on the video, subscribe to the channel if you like trading and investing, and check us out on Instagram, Discord, and TikTok. We have an amazing trading investing community. But let’s first talk about why we’ve actually seen a selloff in Bitcoin. It’s not uncommon for us to see a significant runup leading into the Bitcoin halving because common sense would lead us to believe that if we see the mining rewards get cut in half, we’re also going to see the available supply of Bitcoin drop significantly, which from a simple economic standpoint would mean that there’s a high chance that the price will increase.

The Impact of Institutional Money and Economic Factors

In addition to a tremendous amount of institutional money entering the market, to most investors, it only seems intuitive that Bitcoin absolutely skyrockets from here. But as us experienced investors know, and as I’ve been talking about in all of the previous videos, I want to show you a few reasons why this is normal and explain to you why this isn’t as big a deal as a lot of people think it is. The first and biggest reason is because even though we all like to think that Bitcoin is a tremendous store of value and that cryptocurrency is being adopted, cryptocurrency is still viewed as a risk-on asset similar to something like a stock.

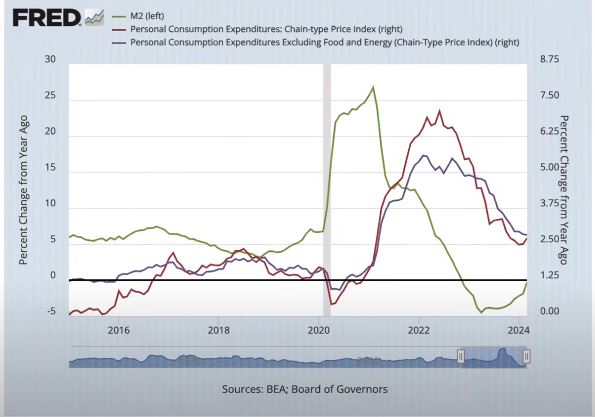

The Influence of Monetary Policy on the Crypto Market

The things that control the stock market primarily are the monetary policy decisions from the federal government, especially interest rates. Stocks and bonds have an inverse correlation; when there’s an expectation for interest rates to drop, stocks will often times price in that anticipation and go on an extreme run. We’ve seen that over the past 6 months with even the Dow Jones, which tracks the 12 largest industrial stocks in the US Stock Market, increasing around 12% because the federal government was anticipating between 3 to 5 rate cuts into the next year

Bitcoin’s Response to Interest Rate Changes

Leading into our halving event and those expected rate cuts, that’s why Bitcoin started tearing up as well. Before 2021, Bitcoin never really scaled based on the interest rate decisions until we saw the pandemic. During COVID, because the government cut the rates to zero and started injecting a tremendous amount of money into the system, fixed income that is normally lucrative with very high interest rates became absolutely worthless. Then all the money piled into the stock market as well as Bitcoin as a hedge on inflation for the US dollar.

Historical Bitcoin Price Movements and Interest Rates

- You can see right as the interest rates started increasing again, this is exactly where we also saw the price of Bitcoin sell off from its 2021 all-time highs.

- Now, most people are saying that there’s only going to be about two interest rate cuts in 2024, so that definitely put a damper not only on stocks but correspondingly on the overall crypto market.

- But right now, considering that the debt-to-GDP ratio is at the highest we’ve ever seen it, at a certain point we’re going to have to drop the interest rates.

- Depending on when this does happen, it’s probably going to align perfectly with where we expect cryptocurrency to continue breaking highs and proceed with the bull market.

The Role of Interest Rates in Cryptocurrency Adoption

This is honestly probably one of the primary drivers as to what actually kicked off the beginning of large-scale cryptocurrency adoption. We’ve seen this in previous cycles. For example, 6 months before the 2012 cycle, we saw this sort of plateau price with the price barely doing anything for probably about a month or two before we started to see the increase in price. In the 2016 cycle, for several months, we actually saw negative growth down here about halfway through the cycle, the all-time highs. In the 2020 cycle, we saw a lot of sideways price action and even a few sell-offs before once again seeing that massive runup in price action.

Current Bitcoin Market Conditions and Long-Term Prospects

| Key Points | Details |

|---|---|

| Bitcoin’s movement over the past year | Bitcoin’s basically moved up around 400%. |

| Current status | We’re only down about 15% from all-time highs. |

| Fundamentals | Nothing fundamentally that initially drove this move in Bitcoin has changed whatsoever. |

| Change in excitement | The only thing that has changed is that it’s less exciting. |

| Interest rate decision uncertainty | Since we’re unsure about the interest rate decision, things might take a little bit longer. |

| Market behavior | People like to chase the shiny object. |

| Institutional participation | The thing that is different about this cycle is the amount of institutional participation. |

Institutional Participation and Market Volatility

Whereas in previous cycles, once the hype dies off, we really needed a lot of retail holders to be able to gain interest again for large money to be able to play off of that and push the narrative. At this point, a lot more investors feel a lot more safe holding Bitcoin long-term. So, a lot of people, if they see the price of Bitcoin sell off significantly, especially knowing what’s happened in all of the previous cycles, are more likely to buy up the supply as it drops. This is typically what happens with any maturing asset or market: as there’s more capital in it, the volatility tends to drop because more people believe in the long-term value of it, which has led to the capital entering the market in the first place.

Future Opportunities in the Altcoin Market

If we are to see a continuation of this sell-off, it’s probably not going to last all that long. When it does flip around, it’s going to present a plethora of whole new opportunities for us in the altcoin market to be able to find those gems and be able to trade them up.